Tax Cuts Are Coming

Stage 3 Tax Cuts: What do they mean for you?

The stage-3 tax cuts are the final phase of the Morrison government’s 2018 three-step plan to reform Australia’s tax system and will come into effect in July 2024.

Stage 1 introduced low and middle income tax offset (LAMITO) worth p to $1,080 a year to those earning between $30,000 and $126,000.

Stage 2 included raising 32.5% marginal tax bracket from $37,001-$90,000 to $45,001-$120,000 as well as raising earning threshold from $90,000 to $120,000 before 37% tax rate kicked in. Taxpayers earning less than $45,000 were also included to be eligible for existing low-income tax offset.

Stage 3 involves completely abolishing 37% marginal tax bracket and lowering 32% marginal tax rate to 30%.

Tax Brackets At Present:

- up to $18,200 – no tax

- $18,201 to $45,000 – pay a 19% tax rate

- $45,001 to $120,000 – pay a 32.5% tax rate

- $120,001 to $180,000 – pay a 37% tax rate

- $180,001 plus – pay a 45% tax rate

Tax Brackets Under Stage 3:

- up to $18,200 – no tax

- $18,201 to $45,000 – pay a 19% tax rate

- $45,001 to $200,000 – pay a 30% tax rate

- $200,001 plus – pay a 45% tax rate

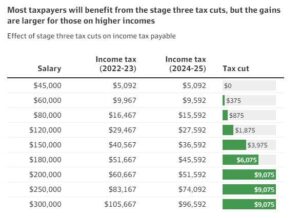

How big will my tax cut be?

Key Takeaways:

The Stage-3 tax cuts will take effect from July 1, 2024 and they have a huge impact on medium to high-income earners. Although there has been an outcry to repeal these tax cuts, they remain legislated. A majority of Australians feel that they only contribute to wealth inequality and prefer other, more effective policies that would suit changing macro- environment. They are estimated to cost the budget $243 billion in lost tax revenue over ten years after being introduced.

Author

May Aung