More change for SMSF

Self-Managed Super Funds (SMSFs): Transfer Balance Cap Changes Are Coming

The introduction of a Transfer Balance Cap (TBC) from July 2017 put a limit on how much an individual could transfer from their superannuation balance into retirement phase pensions.

To track an individual’s use of their TBC, a Transfer Balance Account (TBA) is created to record transactions from the time they first establish a pension. These transactions are recorded depending on the reporting of various events, with the most common being establishment of retirement phase pensions and withdrawal of part or all of pension as lumpsums.

Current Law: Valid until 30 June 2023

Currently, SMSFs will be either:

Quarterly reporters – reporting of events lodged within 28 days after the end of quarter in which the event occurs.

Annual reporters – reporting of events no later than lodgement of Annual Return for the year in which the event occurs.

The option between quarterly and annual reporting will depend if the total balance of any of SMSF’s members was less than $1million on 30 June the year before the first member starts a pension. If less than $1 million, you can report annually. If $1million of more, you must report quarterly.

New Laws: Valid from 1 July 2023

From 1 July 2023:

All SMSFs will be required to report Transfer Balance Account events on a quarterly basis.

This means a member’s total super balance will no longer be relevant in determining the reporting deadline.

Existing quarterly reporters are not given an extension for lodgements.

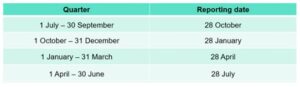

Reporting dates will be as follows:

And note – sometimes an SMSF should be lodging their TBARs even earlier than 28 days after the end of the quarter!

Late Lodgement Penalties

While the ATO hasn’t applied penalties for late lodgers to date, keep in mind that a penalty unit (currently $275) can apply for each 28 days (or partially) that a late lodgement occurs – up to a maximum of 5 penalty units.

Author

May Aung